sites4volga.ru

Tools

Difference Between Doordash And Ubereats

This is vital. Drivers are somewhat agnostic when it comes to who they're working with. They typically hop between different platforms and can have multiple. As a delivery driver, finding valuable opportunities is crucial – and as far as rates go, GrubHub can be a great place to start your search. According to Indeed. DoorDash is busier and has significantly higher paying orders. DoorDash also only allows so many drivers to Dash per area, unlike Uber Eats who will let anyone. Pick your food order from any menu and add it to your cart with a few taps. That's it. Uber Eats makes it easy to order food delivery online or through the app. UberEats and GrubHub delivers from restaurants, while DoorDash also delivers from stores such as CVS. DoorDash) all charge a commission fee between % for placing What's the difference between DoorDash Drive and using regular DoorDash or UberEats? Though the data isn't readily available, DoorDash reports their Gross Order Value while UberEats reports their Gross booking. And we have the #. With the Dash Pass, you may enjoy free delivery on orders over $15 for $ per month. Skip The Dishes vs UberEats. The apparent distinction between Uber Eats. Revenue Model: DoorDash makes money in a variety of ways, including delivery fees that customers pay, commission fees that it charges restaurants for using its. This is vital. Drivers are somewhat agnostic when it comes to who they're working with. They typically hop between different platforms and can have multiple. As a delivery driver, finding valuable opportunities is crucial – and as far as rates go, GrubHub can be a great place to start your search. According to Indeed. DoorDash is busier and has significantly higher paying orders. DoorDash also only allows so many drivers to Dash per area, unlike Uber Eats who will let anyone. Pick your food order from any menu and add it to your cart with a few taps. That's it. Uber Eats makes it easy to order food delivery online or through the app. UberEats and GrubHub delivers from restaurants, while DoorDash also delivers from stores such as CVS. DoorDash) all charge a commission fee between % for placing What's the difference between DoorDash Drive and using regular DoorDash or UberEats? Though the data isn't readily available, DoorDash reports their Gross Order Value while UberEats reports their Gross booking. And we have the #. With the Dash Pass, you may enjoy free delivery on orders over $15 for $ per month. Skip The Dishes vs UberEats. The apparent distinction between Uber Eats. Revenue Model: DoorDash makes money in a variety of ways, including delivery fees that customers pay, commission fees that it charges restaurants for using its.

Compare DoorDash versus UberEATS for CEO Rating, Overall Culture Score, and more on Comparably. Doordash is better here but Uber does hit you with nice delivery orders, every so often. Other posts. DoorDash is a food delivery app that partners with local restaurants to bring users their favorite meals. With over , restaurants in 4,+ cities across. One of the biggest is that DoorDash drivers can schedule their hours in advance while Uber Eats doesn't offer advanced scheduling. Uber Eats drivers open the. DoorDash also has the highest cash out fee at $ , compared to UberEats, which is increasing to $ and Grubhub at 50 cents per cashout. UberEats allows. DoorDash is busier and has significantly higher paying orders. DoorDash also only allows so many drivers to Dash per area, unlike Uber Eats who will let anyone. The price, like others on our list, is $ a month. The Uber Eats app is fairly simple and user-friendly. Delivery fees are easy to locate on the main search. With the Dash Pass, you may enjoy free delivery on orders over $15 for $ per month. Skip The Dishes vs UberEats. The apparent distinction between Uber Eats. To ensure that our partners receive the best possible service, DoorDash charges a commission or fee for orders processed using our products and services. Keep. UberFRESH became UberEATS. Uber also released a separate app for UberEATS, to differentiate between its food delivery service and its rideshare service. Revenue Model: DoorDash makes money in a variety of ways, including delivery fees that customers pay, commission fees that it charges restaurants for using its. Get a comparison of working at DoorDash vs UberEATS. Compare ratings, reviews, salaries and work-life balance to make the right decision for your career. Ease of Use: Uber Eats is renowned for its intuitive app design, making it easy for users to navigate through various menus and place orders with just a few. DoorDash is an online ordering system that puts restaurant in contact with customers seeking takeout and delivery services. DoorDash supports promotions. Related: DoorDash or Postmates The main difference between Postmates and UberEats is the fact that you can reject as many deliveries as you want for Postmates. One of the key factors that customers consider when choosing a food delivery app is the cost of delivery fees. Both DoorDash and Uber Eats. DoorDash is an online ordering system that puts restaurant in contact with customers seeking takeout and delivery services. DoorDash supports promotions. Compare sites4volga.ru to other websites sites4volga.ru isn't sites4volga.ru's only competition in the Food and Drink > Restaurants and Delivery industry. See how. Compare Deliveroo vs. DoorDash vs. Uber Eats using this comparison chart. Compare price, features, and reviews of the software side-by-side to make the best. Uber Eats lets you set your schedule. Unlike DoorDash, there's no advanced scheduling component. However, the company does cap the number of drivers for local.

Best Interest Rates For Cars

The best interest rate on a car loan is the lowest one you can get, but watch out for fees that will drive up your cost. Although it can vary, most new and used car loans have a term of roughly three years, and an annual percentage rate between 3% and %. The average interest. Find the best car loan by comparing rates from multiple lenders and learn everything you need to know about an auto loan before you make a decision. On a three-year car loan, the average interest rate is around 3% to %. However, you may be offered differently based on your credit score as well as where. Find the best car loan by comparing rates from multiple lenders and learn everything you need to know about an auto loan before you make a decision. What is a Good Interest Rate for a Car Loan? ; , %, , % ; , %, , % ; , %, , %. Good rates are generally under 4%, which is what my parents got. Typical rates are around %, and anything above 10% starts to get on the high. Best Car Deals in - Lowest Interest Rate by Model ; GMC, Sierra , % for 7 Years ; Nissan, Armada, % for 7 Years ; Jeep, Grand Wagoneer, % for 6. Used car (dealer): Example: A 5-year, fixed-rate used car loan for $32, would have 60 monthly payments of $ each, at an annual percentage rate (APR) of. The best interest rate on a car loan is the lowest one you can get, but watch out for fees that will drive up your cost. Although it can vary, most new and used car loans have a term of roughly three years, and an annual percentage rate between 3% and %. The average interest. Find the best car loan by comparing rates from multiple lenders and learn everything you need to know about an auto loan before you make a decision. On a three-year car loan, the average interest rate is around 3% to %. However, you may be offered differently based on your credit score as well as where. Find the best car loan by comparing rates from multiple lenders and learn everything you need to know about an auto loan before you make a decision. What is a Good Interest Rate for a Car Loan? ; , %, , % ; , %, , % ; , %, , %. Good rates are generally under 4%, which is what my parents got. Typical rates are around %, and anything above 10% starts to get on the high. Best Car Deals in - Lowest Interest Rate by Model ; GMC, Sierra , % for 7 Years ; Nissan, Armada, % for 7 Years ; Jeep, Grand Wagoneer, % for 6. Used car (dealer): Example: A 5-year, fixed-rate used car loan for $32, would have 60 monthly payments of $ each, at an annual percentage rate (APR) of.

APRs listed are our best rates. Your rate may be higher based Credit union car loans, like Mission Fed's auto loans, often have lower interest rates. Let us do the shopping for you. Get discounted pricing and our best rates on your next vehicle purchase in partnership with TrueCar. Rates starting at % APR. Finding a 0% financing offer on a new car, truck or SUV is like buying a winning lottery ticket, as it can save buyers thousands of dollars over the life of. Compare auto loan rates in September ; Carvana, %%, months ; myAutoLoan, Starting at %, months ; Upstart, %%, months. Drive Away With Savings! · Auto rates as low as % APR* · Up to $ cash back when you refinance**** · Defer your first payment up to Days*** · New and used. View and compare current auto loan rates for new and used cars, and discover options that may help you save money. Apply online today at Bank of America. APR by Credit Score (New Car) · % · % · % · % · %. Rates as of Sep 08, ET. Disclosures and Definitions Advertised “as low as” annual percentage rates (APR) assume excellent borrower credit history. Your. Get on the road with low interest rates ; Model Year, 78 Months, % APR ; Model Year, 84 Months, % APR ; Model Year, 60 Months, Best Auto Loan Rates of September ; LightStream · Numerous auto loan types · Fast online application · No vehicle-specific restrictions · % ; Bank of America. 7 steps to get the best auto loan rates · 1. Determine your budget · 2. Check your credit · 3. Do your research · 4. Apply for preapproval and shop for your car · 5. Around 4% is traditionally what is recommended for a loan on a car. Now with interest being way up, getting 4% might be harder. Maximum APR is %. If you change your payment method to coupon at any time, your interest rate will increase by% Annual Percentage Rate (APR). PSECU. Auto loans through Altura are fast and easy. Get car loans with low interest rates. See car loan rates and apply now Tee Up A Great Auto Rate. Now. Auto Loan Interest Rates for + Model Year Vehicles · 36 Months, %, $ 48 Months, %, $ 60 Months, %, $ 72 Months, %. Best auto loan rates of September ; PenFed Auto Loans · Starting at % · New vehicles, used vehicles, refinancing ; MyAutoLoan · Starting at % · New. It looks like the best auto loan interest rate goes from % to % for new vehicles and % to % for used vehicles or certified pre-owned models. New/Used Vehicles ; Up to 48 Months, %*, %* ; Up to 60 Months, %*, %* ; Up to 72 Months, %*, %* ; Up to 84 Months, %*, %*. Car loan rates as low as % APR*. Take your instant online preapproval to a dealership; Low-rate loans with up to % car financing** (purchase price. The average interest rate for auto loans on new cars is %. The average interest rate on loans for used cars is %.

Personal Property Loan Rates

Today's Mortgage Rates. Get your rate, and you could lock it in for up to 60 days These rates and monthly payments are based on a $, mortgage. Annual Percentage Rate will never be more than % or less than %. This is a variable rate product. Property insurance is required. Additional discounts. Personal loan rates currently range from around 7% to 36%, depending on the lender, borrower creditworthiness and other factors. At a % interest rate, the APR for this loan type is %. The monthly payment schedule would be: payments of $1, at an interest rate of %. Compare Canada mortgage rates. Find the best mortgage rates in Canada from the Big Banks and lenders. Get expert mortgage rate insights daily. Explore Rockland Trust's personal home loan options - from First-Time Homebuyers to Jumbo loans - and get up-to-date mortgage rates. Current rate range is % to % APR. Excellent credit and up to a three-year term are required to qualify for lowest rates. Main Street Bank's current loan interest rates on consumer loans and lines of credit, including home equity, auto loans, and personal loans. We can help you at any part of the home buying process. See our current mortgage rates, low down payment options, and jumbo mortgage loans. Today's Mortgage Rates. Get your rate, and you could lock it in for up to 60 days These rates and monthly payments are based on a $, mortgage. Annual Percentage Rate will never be more than % or less than %. This is a variable rate product. Property insurance is required. Additional discounts. Personal loan rates currently range from around 7% to 36%, depending on the lender, borrower creditworthiness and other factors. At a % interest rate, the APR for this loan type is %. The monthly payment schedule would be: payments of $1, at an interest rate of %. Compare Canada mortgage rates. Find the best mortgage rates in Canada from the Big Banks and lenders. Get expert mortgage rate insights daily. Explore Rockland Trust's personal home loan options - from First-Time Homebuyers to Jumbo loans - and get up-to-date mortgage rates. Current rate range is % to % APR. Excellent credit and up to a three-year term are required to qualify for lowest rates. Main Street Bank's current loan interest rates on consumer loans and lines of credit, including home equity, auto loans, and personal loans. We can help you at any part of the home buying process. See our current mortgage rates, low down payment options, and jumbo mortgage loans.

We'll tailor your loan to finance almost anything — a home renovation Personal Loan Interest Rates. Huntington offers competitive interest rates on. Mortgage, Loan, & Personal Banking Rates. Our competitive rates for loans and savings. Show filters. Retail banking rates ; % (LOC Prime), Secured/Home Equity Line of Credit (HELOC), Apply online ; % (Prime + %), Flex Line Mortgage - HELOC Component. Depending on the lender, your credit score, and other factors, your interest rate might be different. The interest rate on a mortgage loan might be lower than. Personal Loan Rates ; Up To 48 Months, Up to $30,, % ; 49 to 60 Months, Up to $30,, % ; Up to 48 Months, Above $30,, % ; 49 to 60 Months. Fixed-term fixed-rate mortgages. · 1-year fixed-term residential, % · 2-year fixed-term residential, % · 3-year fixed-term residential, % · 4-year fixed. Mortgage points, or discount points, are a form of prepaid interest you can choose to pay up front in exchange for a lower interest rate and monthly payment. Adjustable Rate Mortgage For months 1 to 60, the payment per $ is $ Based on the current index and margin, for months 61 to , the rate would be. Today's competitive mortgage rates ; year fixed · % · % · ; year fixed · % · % · ; 5y/6m ARM · % · % · Mortgage Rates ; 30 year Section , %, %, %, $1, ; 15 year fixed, %, %, %, $1, The following tables are updated daily with current mortgage rates for the most common types of home loans. Search for rates by state or compare loan terms. Today's competitive mortgage rates ; year fixed · % ; year fixed · % ; 5y/6m ARM · %. Personal Loans ; As low as %, Up to 24 months, $, - $50, maximum loan amount ; As low as %, 25 - 36 months, $ - $, - $50, maximum. Our competitive mortgage rates are backed by an experienced staff of mortgage professionals. We update our interest rate table daily, Monday through Friday. home / financial / personal loan calculator. Personal Loan Calculator. Modify The interest rates of personal loans are normally lower than credit cards. Home Improvement Loan rates range from % to % APR. Payment Example: A loan amount of $5, for 36 months has a payment range from $ to $ and. Mortgage Loans (Refinance) ; Year Fixed Rate, %, % ; FHA 30 Year Fixed, %, % ; ADJUSTABLE RATE MORTGAGES^ ; 5/1 Conforming, %, %. Signature (unsecured) Loan Rates · Interest rate is dependent upon the credit qualifications of the borrower(s). · A balloon payment for the balance owed is due. % APR · Home Equity 5 Year Fixed At a % interest rate, the APR for this loan type is %. The monthly payment schedule would be: · Home Equity Tower Federal Credit Union in Maryland, Virginia and Washington D.C. is a financial institution that offers valuable personal banking solutions including.

Swing Trading Examples

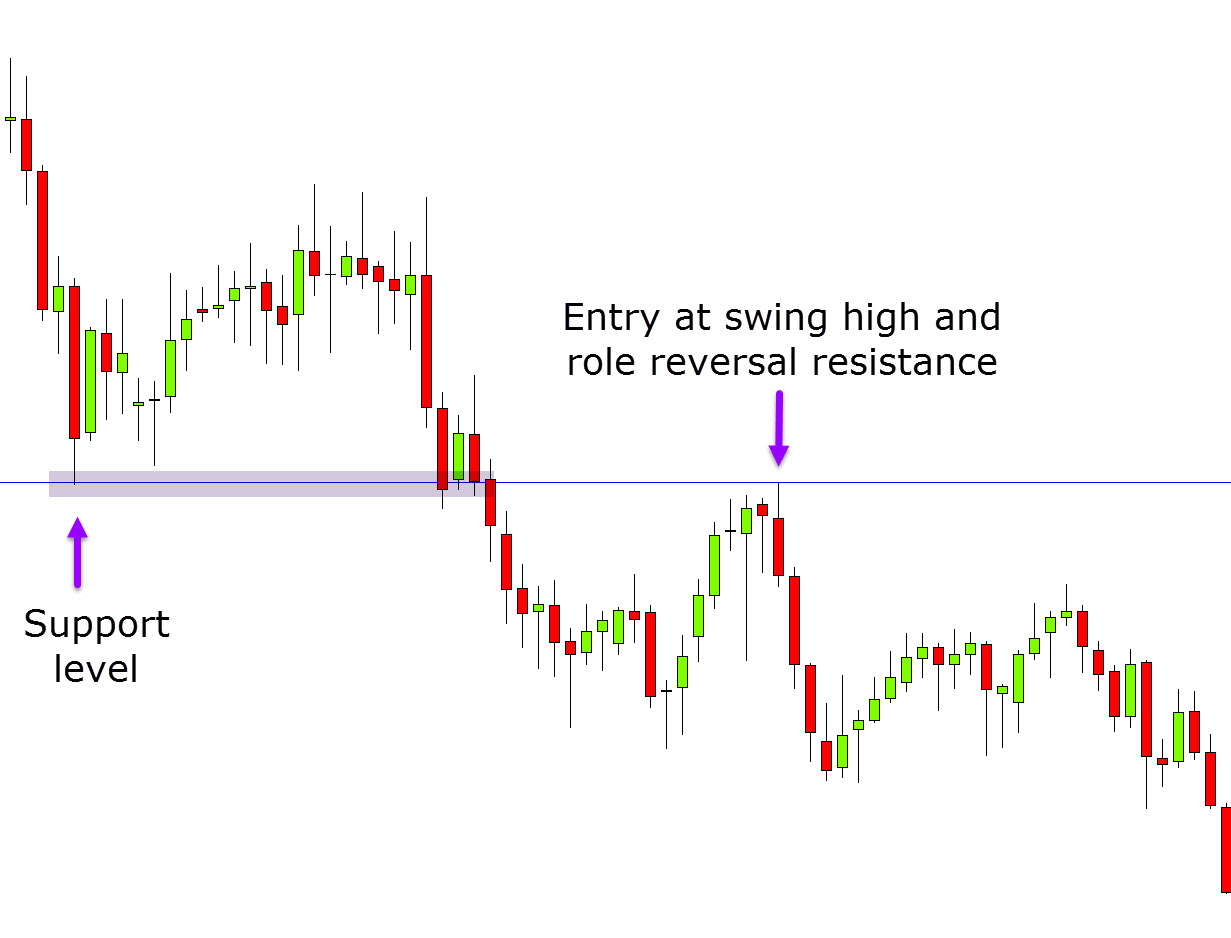

Swing Trading is a technique of trading where an investor invests a sum of amount in stocks or any other financial instruments for a short. Swing trading options are a great technique for beginners and advanced traders alike. The most common ways to swing trade options are naked calls and puts. Swing trading strategies attempt to capitalize on price fluctuations over the short term. Learn how traders use swing trades. To maximize profits, swing traders should focus on stocks in strong sectors with positive momentum. Keep an eye on industry trends and financial. This guide covers an example that illustrates how to swing trade stocks using a Fibonacci retracement and helps you to identify your swing trading entry and. Swing trading is a trading strategy that aims to capture short- to medium-term gains in a financial instrument (like stocks or cryptocurrencies) by holding. For example, in an uptrend, you aim to buy (go long) at “swing lows.” And conversely, sell (go short) at “swing highs” to take advantage of temporary. Swing trading comes in various forms, some trade classical chart patterns like head and shoulders, others trade the short-term sentiment readings, and others. Pinpointing a Reversal · Oscillator Divergence · Bullish and Bearish Engulfing Patterns · Indecision Candles · More Swing Trade Examples · What Is Swing Trading? Swing Trading is a technique of trading where an investor invests a sum of amount in stocks or any other financial instruments for a short. Swing trading options are a great technique for beginners and advanced traders alike. The most common ways to swing trade options are naked calls and puts. Swing trading strategies attempt to capitalize on price fluctuations over the short term. Learn how traders use swing trades. To maximize profits, swing traders should focus on stocks in strong sectors with positive momentum. Keep an eye on industry trends and financial. This guide covers an example that illustrates how to swing trade stocks using a Fibonacci retracement and helps you to identify your swing trading entry and. Swing trading is a trading strategy that aims to capture short- to medium-term gains in a financial instrument (like stocks or cryptocurrencies) by holding. For example, in an uptrend, you aim to buy (go long) at “swing lows.” And conversely, sell (go short) at “swing highs” to take advantage of temporary. Swing trading comes in various forms, some trade classical chart patterns like head and shoulders, others trade the short-term sentiment readings, and others. Pinpointing a Reversal · Oscillator Divergence · Bullish and Bearish Engulfing Patterns · Indecision Candles · More Swing Trade Examples · What Is Swing Trading?

One successful swing trading example is riding the trend, where traders identify and follow the prevailing market trend. By analyzing charts and using technical. Trend trading strategies can be classified into several groups. For example, trading on level breakouts or a long-term investment strategy. Swing trading. Swing traders, on the other hand, trade less frequently because it takes longer to complete their trades. For example, a stock might be nearing a level of. Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve. Investing involves risk, including. Swing trading is a type of short-term technical analysis-based trading that is used to invest in financial instruments such as stocks, futures, and currencies. Swing traders aim to make a lot of small wins that add up to significant returns. For example, other traders may wait five months to earn a 25% profit, while. For example, let's say you want to buy a car worth six lakhs after two years. You have four lakhs in savings and want to borrow the two lakhs from a bank as a. Swing traders may go long or short the market to capture price swings toward either the upside or downside, or between technical levels of support and. Discord real-time chat server for Brooks Price Action (BPA) trading discussions, BPA trading room support, along with general market chat and international. A general definition of a swing trade is a trade that lasts from a couple of days and up to several months, in order to profit from an anticipated price move in. The most successful trader is Jim Simons, who founded Renaissance Technologies. He is basically the man behind quant investing and his funds managed to make. It's an active trading strategy that captures the swings in market sentiment and allows you to enter and exit at key levels. Swing trading differs from day. Stock splits can be used as a strategy by swing traders to potentially profit from the expected price changes that can occur following a split. For example, if. Breakout trading is a popular strategy among swing traders. It involves identifying key price levels and entering a trade when the price breaks above or below. Swing trading, a popular strategy in the world of stock trading, has gained immense traction due to its potential for significant gains. It's a technique where. Swing trading is a speculative trading strategy in financial markets where a tradable asset is held for one or more days in an effort to profit from price. Swing trading attempts to identify “swings” within a medium-term trend and enter only when there seems to be a high probability of winning. For example, in an. Swing traders usually target a larger market share and wait for a deal to emerge for the underlying – when it happens, they trade in the direction of the trend. Here's a quick video example to kick things off. As the name implies, swing trading is an attempt to profit from the swings in the market. These swings are made. Flexibility: Swing traders can go with or against the trend. For example, traders might attempt to buy EUR/USD on dips when it is trending higher but close the.